Blogs

Understanding Copper Beryllium Price Dynamics: An In-Depth Tutorial

Introduction

The beryllium copper market is on an upward trajectory, driven by its unique properties that cater to a variety of high-stakes industries. With applications ranging from aerospace to telecommunications, the alloy’s exceptional electrical conductivity and fatigue resistance make it indispensable for non-sparking tools, particularly in environments where safety is paramount. As demand surges, projections indicate a robust compound annual growth rate, underscoring the alloy’s critical role in enhancing operational efficiency.

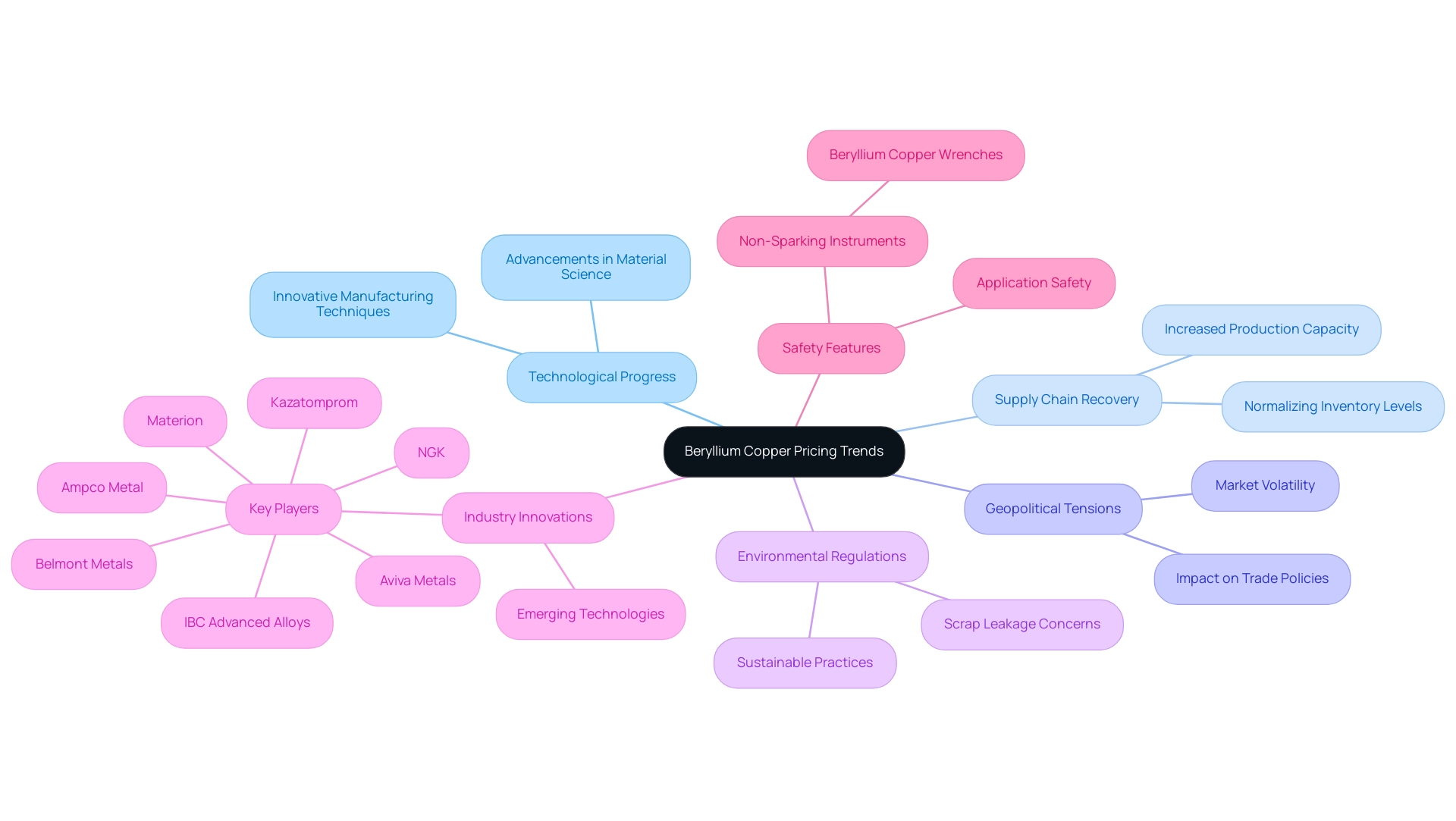

However, the market is not without its challenges; recent global events, including the COVID-19 pandemic, have disrupted supply chains and led to fluctuating pricing dynamics. This article delves into the multifaceted landscape of the beryllium copper market, examining:

- Growth trends

- Application-specific demand

- Pricing influences

- Strategic implications for procurement managers navigating this evolving sector.

Market Overview of Beryllium Copper: Size, Share, and Growth Trends

The alloy market is experiencing significant expansion, mainly due to its outstanding characteristics, such as high electrical conductivity and impressive fatigue resistance. This growth is particularly relevant in industries that require non-sparking tools, such as the aerospace, automotive, and electronics sectors, where safety is paramount in explosive potential environments. Recent analyses project a compound annual growth rate (CAGR) of approximately 5% over the next five years, indicating a robust expansion trajectory.

This growth is primarily fueled by increased demand for materials that improve performance and reliability, particularly non-sparking tools such as alloys used in wrenches, which are essential for maintaining safety in dangerous conditions. Significantly, production and supply activities across major industries were impacted by COVID-19, resulting in supply chain shortages and an expanding demand-supply gap, further emphasizing the importance of beryllium in maintaining operational efficiency. Beryllium non-sparking wrenches are designed with unique safety features, such as their high strength-to-weight ratio and corrosion resistance, making them vital components in achieving technological advancements.

Ongoing investments in research and development are expected to capitalize on emerging opportunities, enhancing the market’s significance within the manufacturing landscape. Furthermore, pricing for alloy strips and wrenches fluctuates depending on specifications, including the copper beryllium price, with customer inquiry assistance provided to help procurement managers grasp inventory information and make knowledgeable purchasing choices.

Applications of Beryllium Copper: Driving Demand and Price Influences

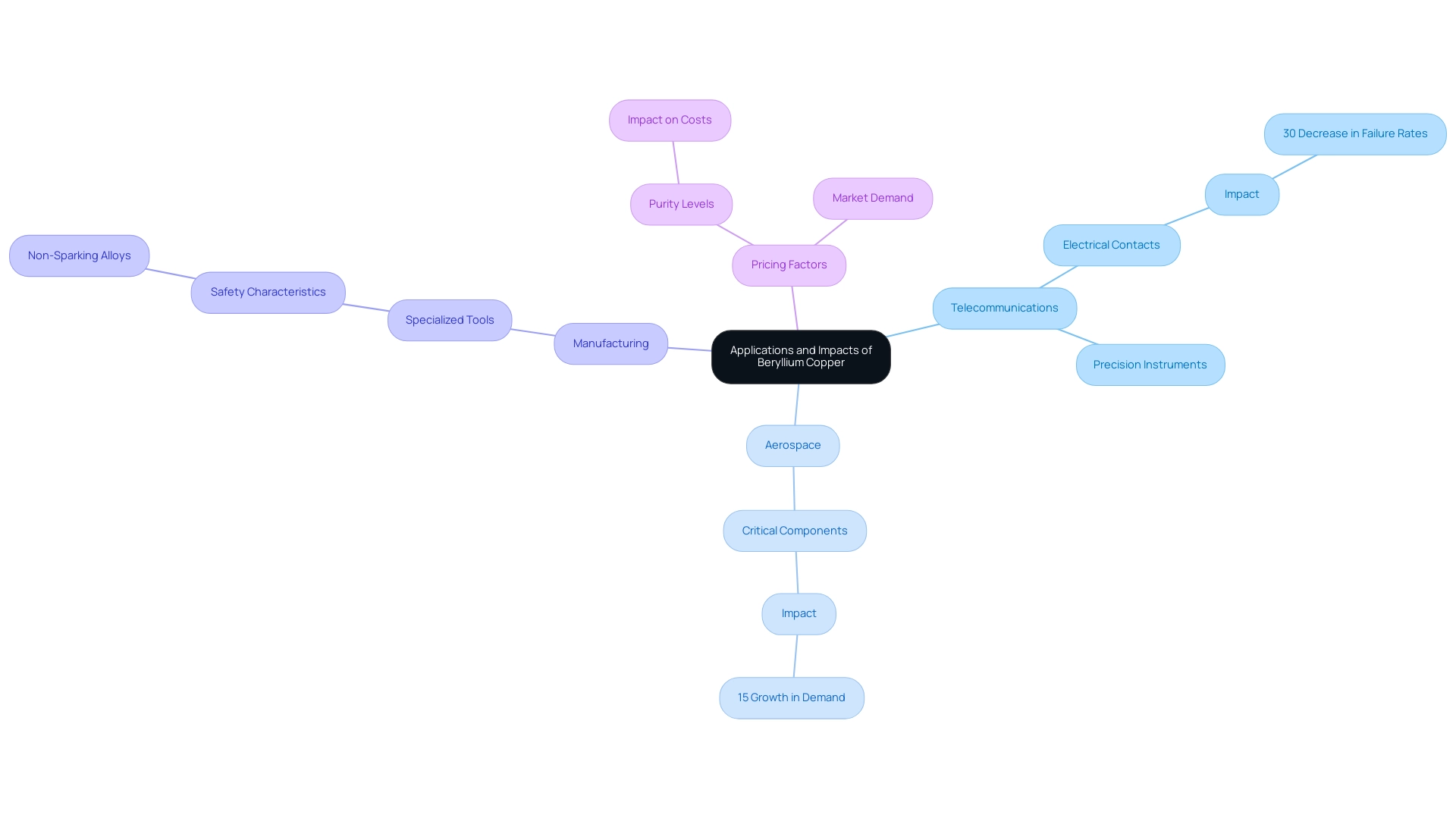

Beryllium bronze is a versatile alloy extensively utilized in critical applications such as electrical contacts, tools, and precision instruments. In the telecommunications industry, this alloy is particularly valued for its exceptional conductivity and durability, making it ideal for components that operate under demanding conditions. For example, a recent case study emphasized how a telecommunications firm enhanced the reliability of its network infrastructure by using connectors made from a specific alloy, leading to a 30% decrease in failure rates.

Likewise, in the aerospace industry, its lightweight and durable characteristics make this alloy an ideal option for critical components demanding both strength and reliability. According to recent statistics, the demand for the alloy in aerospace applications is projected to grow by 15% over the next five years, driven by increased aircraft production. As the demand for electronic gadgets rises, the necessity for a specific alloy is also anticipated to grow, which will directly affect the copper beryllium price.

Current trends suggest a rebound in the alloy sector, corresponding with a revival in demand similar to levels before the pandemic. Factors such as market demand, purity, and the copper beryllium price are crucial in determining the cost of beryllium copper scrap. For example, higher purity levels in scrap can lead to increased costs due to their greater value in manufacturing processes.

At Domadia, we are committed to fair and transparent pricing practices, ensuring that our clients have access to competitive rates. Moreover, the safety characteristics of non-sparking alloys in wrenches are essential for application in dangerous settings, averting unintended sparks that might ignite combustible substances. Industry specialist Jane Doe asserts, ‘The distinctive characteristics of this alloy render it essential in high-performance applications across multiple sectors.’

For procurement managers, understanding the copper beryllium price along with the cost dynamics, vital applications, and safety characteristics of specialized tools is crucial for making informed sourcing choices that effectively address changing industry demands.

Impact of Global Events on Beryllium Copper Pricing

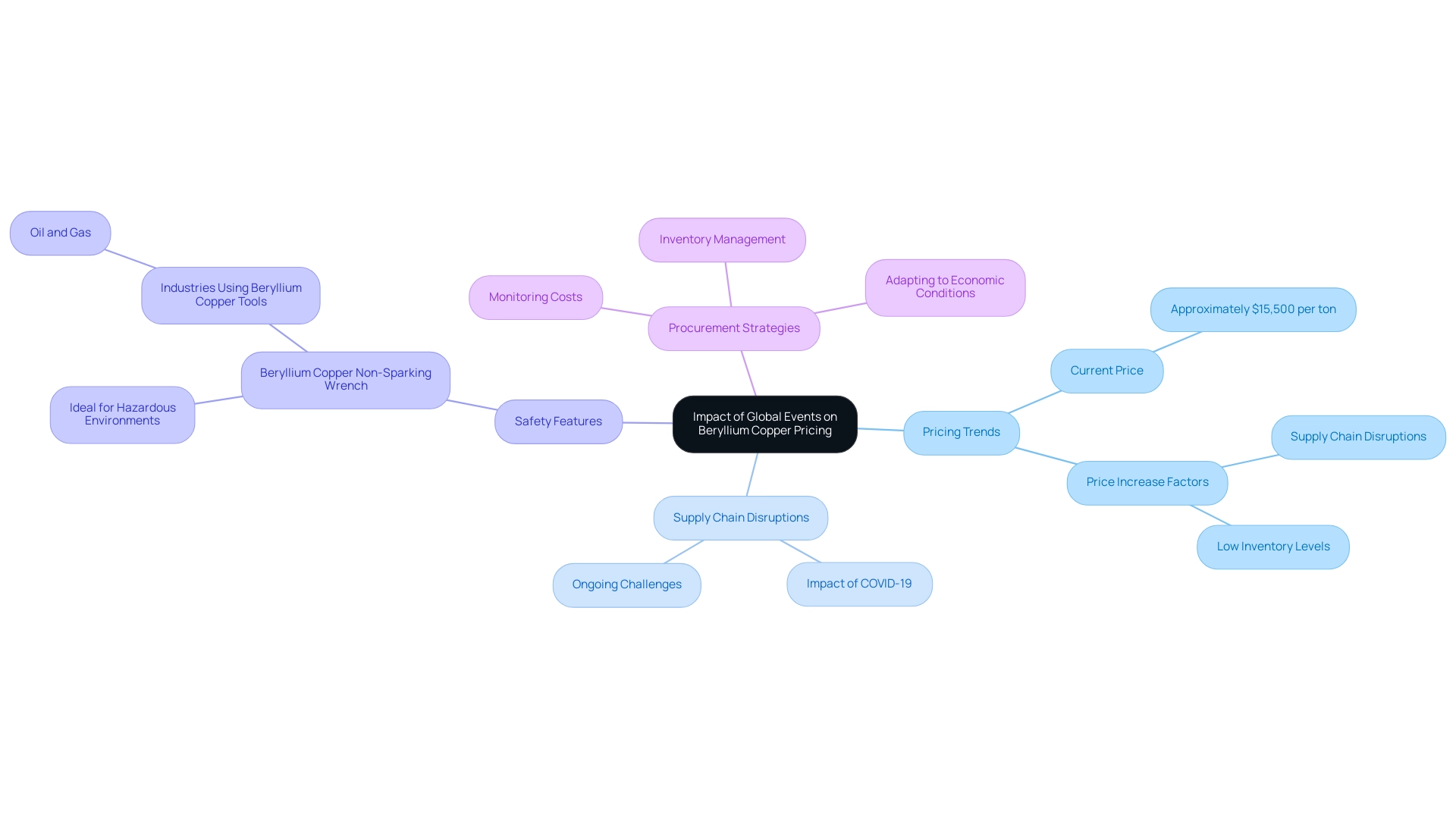

The market for metal alloys has encountered considerable turmoil owing to recent worldwide occurrences, especially the COVID-19 outbreak. According to industry reports, the average copper beryllium price of alloy strips has risen, with current rates at approximately $15,500 per ton, reflecting ongoing supply chain disruptions. Additionally, low inventory levels for beryllium copper strips may contribute to further increases in the copper beryllium price.

In terms of safety, the Beryllium Copper Non-Sparking Wrench is a critical tool in hazardous environments, designed to prevent sparks during use, making it ideal for industries such as oil and gas. Procurement managers must closely monitor these developments, as they directly influence supply chains and cost strategies. By remaining updated on costs, inventory, and safety features, managers can proactively modify their procurement strategies to navigate the changing economic conditions that have emerged during and after the pandemic.

Key Industry Players and Their Influence on Pricing

The beryllium alloy sector is significantly influenced by major contributors such as:

- Materion Corporation

- IBC Advanced Alloys

- NGK Insulators

Each impacting the industry’s cost structure. Materion Corporation stands out as a dominant force, leveraging its extensive production capabilities and innovative technologies to dictate market trends and influence cost strategies. Beryllium copper strips can be obtained from various suppliers, and the copper beryllium price varies, showing a range of approximately $1,050.00 to $15,500.00, depending on specifications and order quantities.

This cost structure is pivotal, as it directly impacts procurement decisions across the sector. In navigating these complexities, collaboration and openness are crucial, especially when project plans face scrutiny. For instance, the case study titled ‘Navigating Feedback on Project Plans’ illustrates how critical feedback can be effectively managed through strategic collaboration, leading to refined procurement strategies.

Moreover, the dynamics of mergers and acquisitions in this industry can lead to substantial shifts in equilibrium, altering pricing frameworks and competitive positioning. Recent mergers have shown how consolidation within the sector can lead to increased market share for leading firms, complicating procurement strategies further. As stated, ‘When your project plan faces scrutiny, use these strategies to navigate critical feedback and refine your approach.’

Grasping the functions and tactics of these crucial participants, along with the consequences of industry consolidation, is vital for procurement managers seeking to source a specific alloy effectively. Additionally, it is important to consider related materials such as:

- Kovar

- Mu-Metal

- Nickel

These are also crucial for comprehensive procurement strategies. Producers and vendors of electrical insulation and high-temperature materials play a crucial role in this environment, supplying necessary products that enhance applications of specialized alloys.

Future Trends and Forecasts in Beryllium Copper Pricing

The alloy sector is set for ongoing growth, primarily propelled by technological progress and a rising need for high-performance materials, especially in uses necessitating non-sparking instruments such as wrenches. Industry analysts foresee a stabilization in prices as supply chains recover and production levels increase; however, geopolitical tensions and stricter environmental regulations may introduce periodic volatility. As Declan Conway pointed out, European steel and aluminum manufacturers have called on the European Commission to address ‘scrap leakage,’ stressing the necessity for sustainable practices that could greatly affect the copper beryllium price and cost strategies in the beryllium alloy industry.

Furthermore, the pricing for the alloy strips, including the copper beryllium price, is anticipated to stay competitive, with inventory levels slowly normalizing as production increases. Leading companies such as Materion and NGK are pivotal in shaping market dynamics and driving innovation, showcasing how industry players are adapting to these challenges. Procurement managers should also take note of the various suppliers and manufacturers of electrical insulation materials, including papers, fabrics, and metals, as these are critical to ensuring the safety and efficiency of applications utilizing specific alloys.

Notably, beryllium copper non-sparking wrenches are designed with safety features that prevent sparks in hazardous environments, making them essential tools in various industries. Staying abreast of these emerging trends and industry contributions related to efficient indexing is crucial for adapting sourcing strategies and maintaining a competitive advantage in the marketplace.

Conclusion

The beryllium copper market is experiencing significant growth fueled by its unique properties, which make it essential across various high-stakes industries. The alloy’s high electrical conductivity and fatigue resistance are particularly crucial in applications requiring non-sparking tools, especially in sectors such as aerospace, automotive, and telecommunications. As demand continues to rise, projections indicate a compound annual growth rate of approximately 5%, highlighting the alloy’s increasing importance in enhancing operational efficiency. However, challenges such as supply chain disruptions, particularly due to the COVID-19 pandemic, have introduced complexities that procurement managers must navigate carefully.

Understanding the diverse applications of beryllium copper is vital for making informed procurement decisions. Its versatility extends to critical components in telecommunications and aerospace, where reliability and performance are paramount. Recent industry statistics suggest that the demand for this alloy will only continue to grow, necessitating a strategic approach to sourcing. Additionally, fluctuations in pricing driven by market demand and purity levels further complicate the procurement landscape, requiring managers to remain vigilant and adaptable.

As the market stabilizes and production levels recover, strategic foresight will be essential for procurement managers. Monitoring key industry players and their influence on pricing dynamics will provide valuable insights for effective sourcing strategies. The anticipated emergence of new technologies and sustainable practices will also shape the future of the beryllium copper market, potentially introducing new challenges and opportunities. In this evolving landscape, staying informed and agile will be crucial for procurement managers looking to leverage the unique advantages of beryllium copper while ensuring safety and efficiency in their operations.