Blogs

Understanding the Cost of Monel: An In-Depth Tutorial on Pricing and Market Factors

Introduction

As the demand for high-performance materials continues to surge across various industries, understanding the pricing dynamics of Monel 400 becomes imperative for procurement managers. This nickel-copper alloy is not only celebrated for its exceptional corrosion resistance and mechanical strength but also faces fluctuating prices influenced by market trends, geopolitical factors, and supplier strategies.

In 2024, the cost of Monel 400 is expected to range from $20 to $35 per kilogram, reflecting the complexities of sourcing in a competitive landscape. By delving into the factors that drive these price changes, exploring effective sourcing strategies, and adhering to quality standards, procurement professionals can navigate the challenges of Monel procurement with confidence.

This article provides an in-depth analysis of the current market conditions, key influencers of pricing, and actionable insights to empower procurement decisions in an evolving economic environment.

Analyzing the Pricing of Monel 400: Cost Per Kilogram

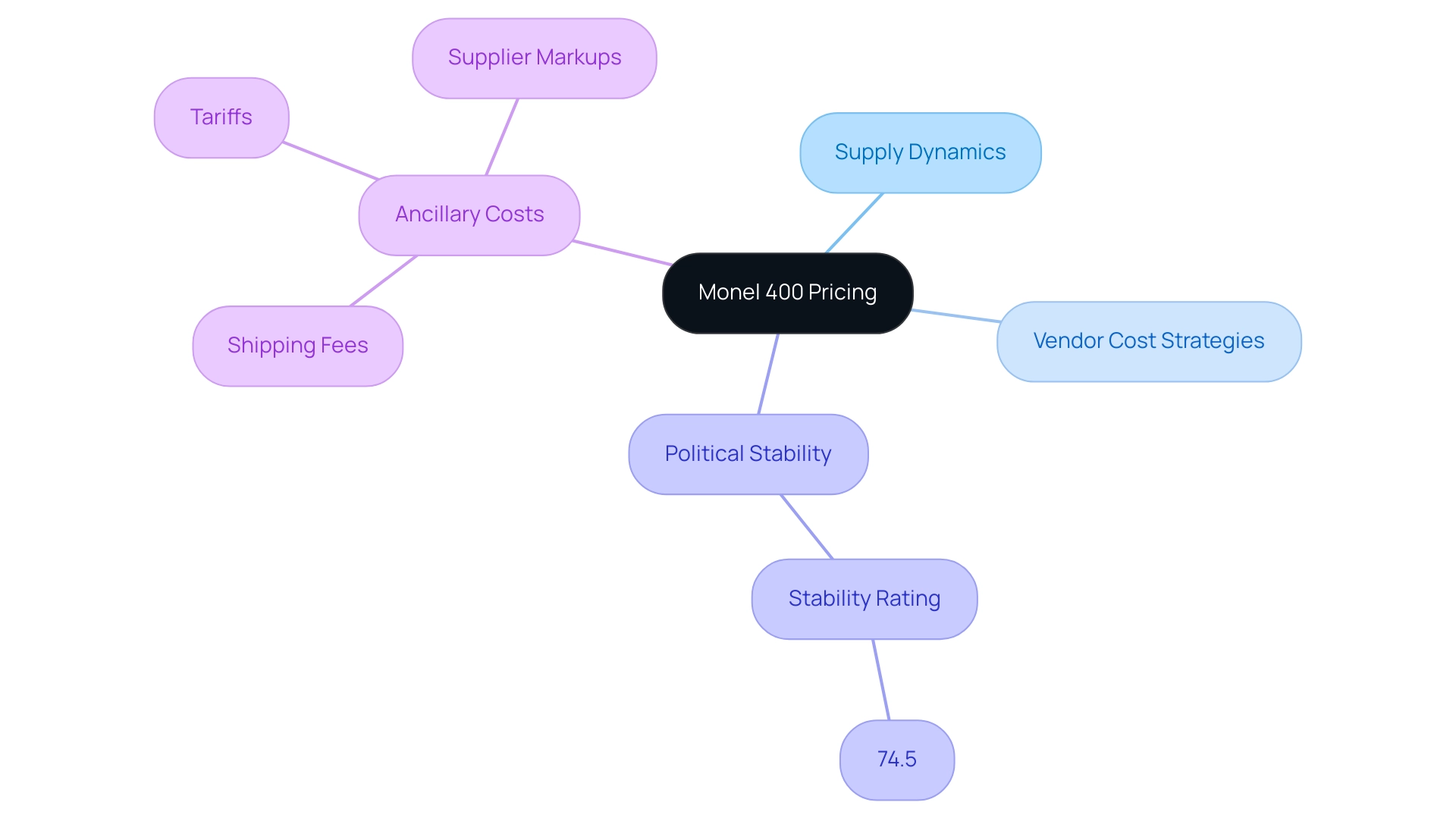

The present value of alloy 400 generally varies between $20 and $35 per kilogram in 2024, affected by numerous elements such as supply dynamics, vendor cost strategies, and order quantities. Notably, the political stability of the top reserve holder, rated at 74.5, plays a significant role in shaping market conditions and pricing trends. When involved in the acquisition of Monel 400, it is crucial to account for not just the cost of Monel but also ancillary expenses, including shipping fees, tariffs, and potential supplier markups.

As Byron Blakey-Milner, a researcher, observes, ‘Additive manufacturing necessitates strict management of the entire process from powder through AM build and post-processing,’ emphasizing the complexities involved in sourcing and production. Additionally, the certification of metal additive manufacturing processes presents challenges due to the need for strict control of process parameters and compliance with aviation certification protocols. Engaging with multiple suppliers and maintaining a regular review of market prices can provide a competitive edge.

Furthermore, bulk purchasing is a proven strategy that can yield significant cost savings, making it a wise approach for purchasing managers. By actively monitoring cost trends and understanding the factors that impact expenses, procurement professionals can secure optimal deals while ensuring the reliability of their material supply.

Factors Influencing Monel Pricing: Composition, Demand, and Applications

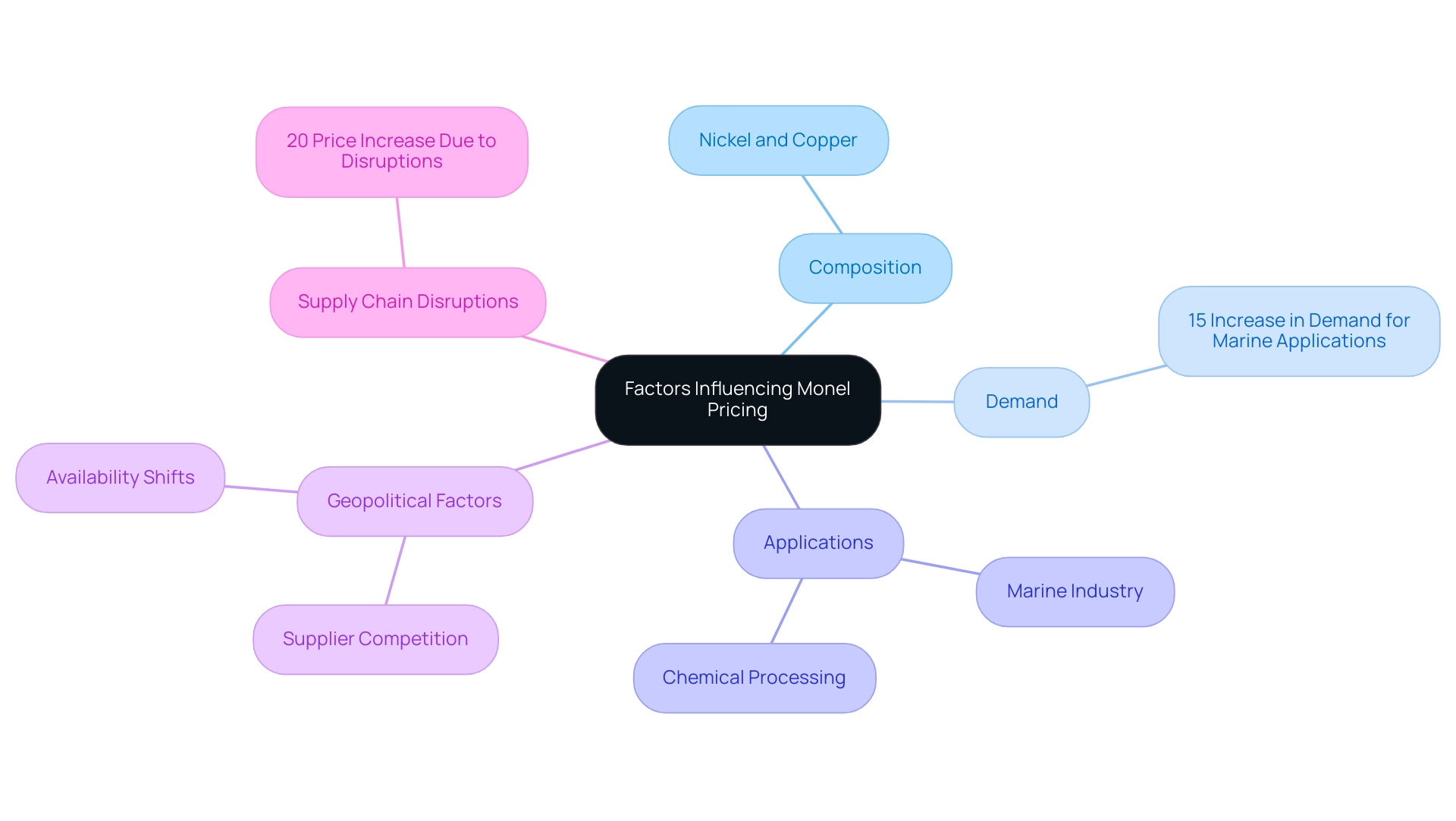

The cost of monel for this alloy, particularly grade 400, is influenced by a multitude of factors, with its unique composition standing at the forefront. Comprising primarily nickel and copper, this alloy 400 is renowned for its exceptional corrosion resistance and mechanical strength, making it indispensable in marine and chemical processing applications. As demand in these sectors rises—especially during periods of economic expansion or heightened industrial activity—the cost of monel can experience significant upward pressure.

According to metallurgists, ‘The unique properties of alloy 400 make it a critical material in industries where corrosion resistance is paramount.’ Geopolitical factors and competition among suppliers further complicate the cost of monel landscape, as shifts in availability can lead to price volatility. Statistics indicate that the demand for alloy 400 in marine applications has surged by 15% over the past year, driven by increased investment in maritime infrastructure.

Furthermore, a recent case study revealed that a major chemical processing company faced a 20% increase in the cost of monel due to supply chain disruptions. Comprehending these economic dynamics is essential for purchasing managers, allowing them to foresee changes in alloy prices and enhance their sourcing strategies efficiently. This strategic foresight is essential for maintaining a competitive edge in an ever-evolving market.

Sourcing Strategies for Monel: Tips for Procurement Managers

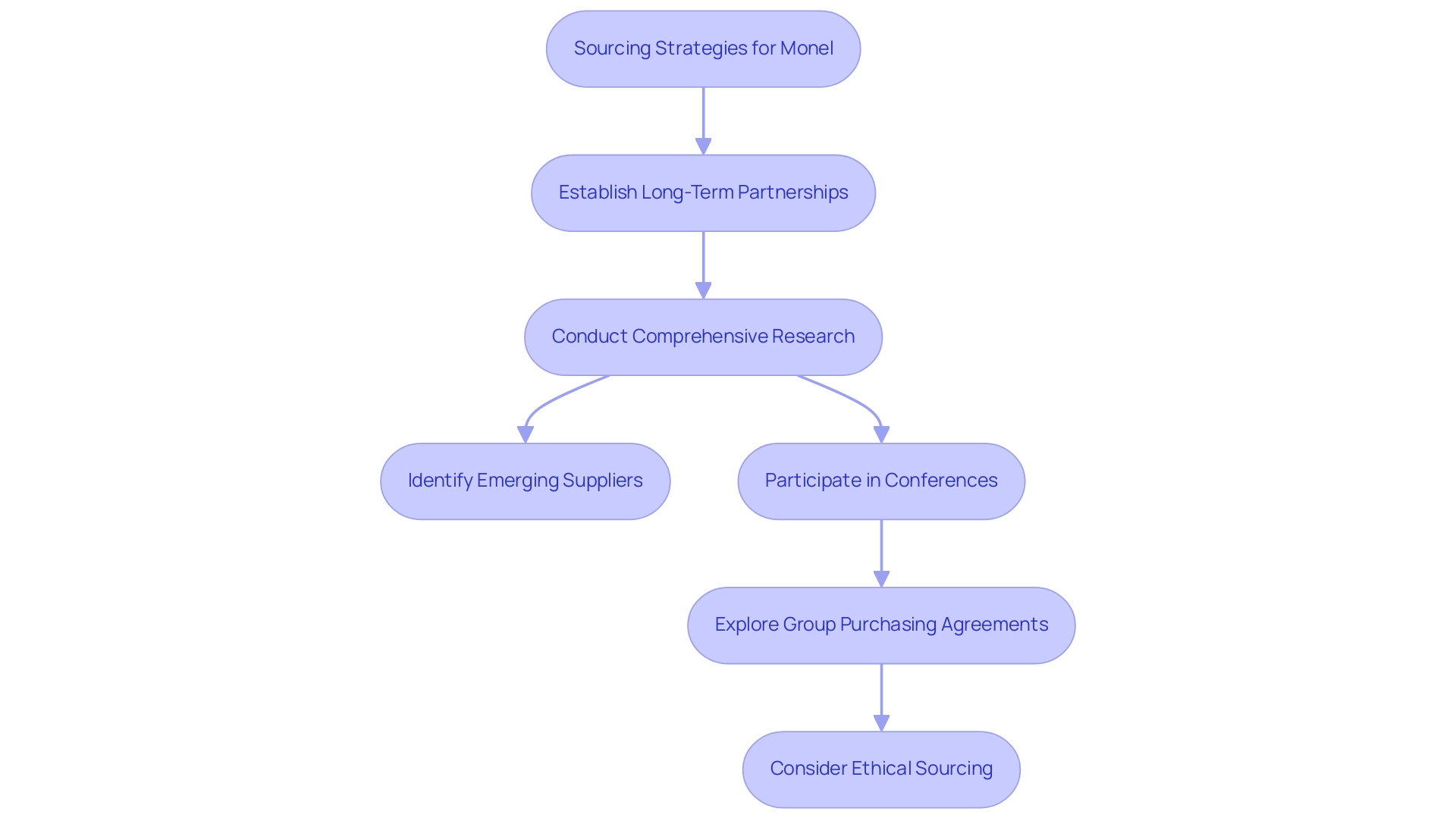

To effectively source this material, procurement managers should prioritize establishing long-term partnerships with dependable suppliers like Domadia, known for their exceptional Mica Tape and premium copper nickel alloys. Their dedication to offering high-quality products and promoting business growth through dependable and genuine service guarantees consistent quality and stabilizes costs, particularly the cost of monel, which is essential during budget season as organizations predict their financial expectations for the upcoming year. Carrying out comprehensive research to identify emerging suppliers and alternative sources of this alloy can yield competitive pricing options.

Participating in industry conferences and trade exhibitions can greatly improve networking opportunities, keeping managers updated about the latest trends and technological advancements. Additionally, exploring group purchasing agreements with other companies can amplify purchasing power, enabling better negotiation terms. Procurement managers should also consider ethical sourcing as part of their strategy, aligning with the responsible practices that strengthen supplier relationships.

Developing a roadmap for procurement processes can assist managers in navigating the complexities of procurement in 2024 and beyond while confidently leveraging partnerships with suppliers like Domadia.

Global Market Trends Impacting Monel Pricing

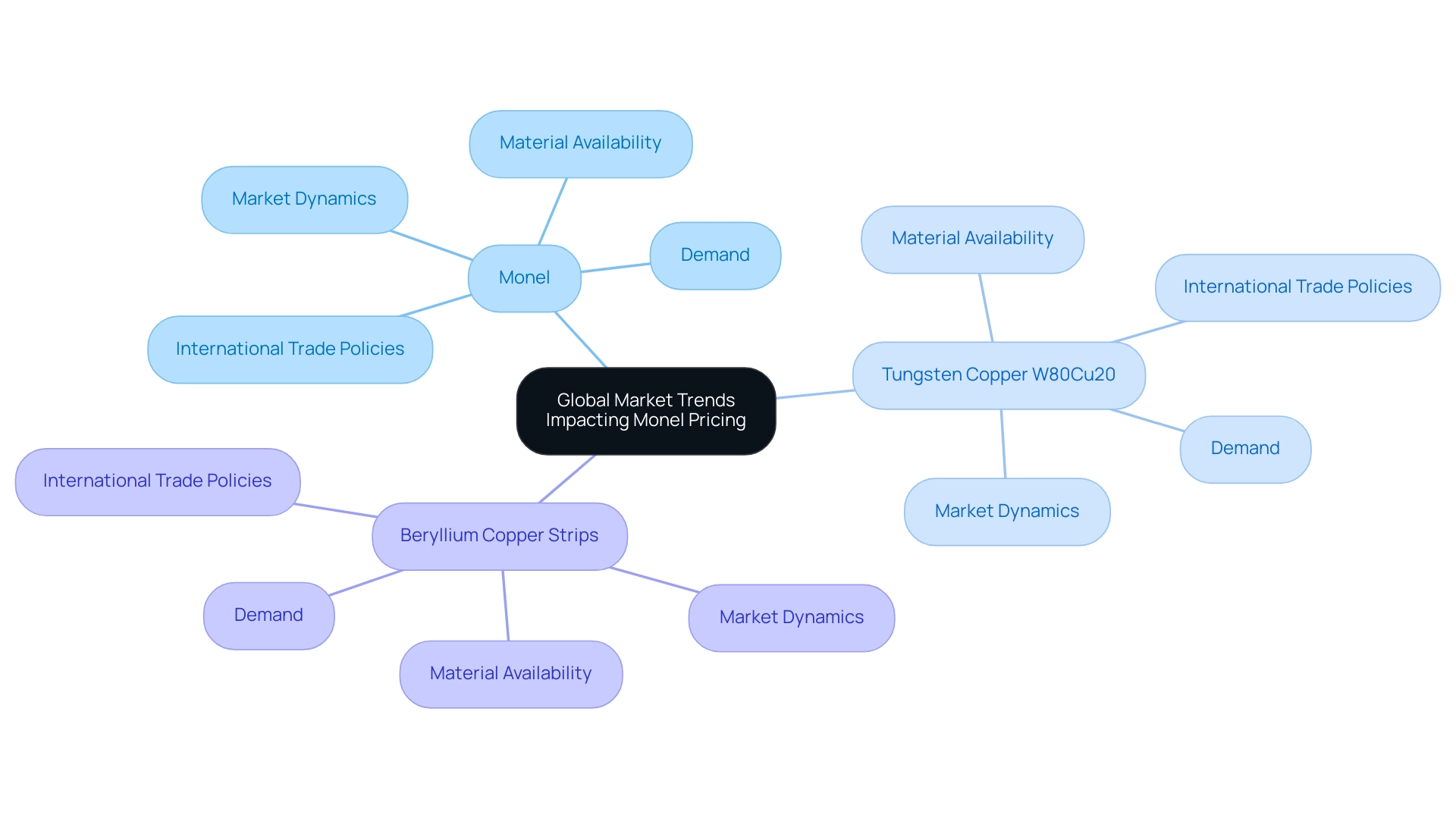

The cost of Tungsten Copper W80Cu20 and Beryllium Copper Strips is influenced by global market dynamics, similar to the cost of Monel. For Tungsten Copper W80Cu20, the current cost is 1,890.00 per unit, reflecting the ongoing fluctuations in material availability and demand. Meanwhile, Beryllium Copper Strips are also subject to pricing pressures, which can be attributed to changes in raw material costs and international trade policies.

As purchasing managers are aware, understanding these dynamics is crucial for optimizing sourcing strategies. Recent trends indicate that the market for tungsten and beryllium copper is also experiencing cautious investor sentiment, with forecasts suggesting potential price stability in the coming year. Staying informed about these pricing trends and their implications will be essential for managers navigating this complex landscape.

Quality Considerations: Ensuring Compliance and Standards

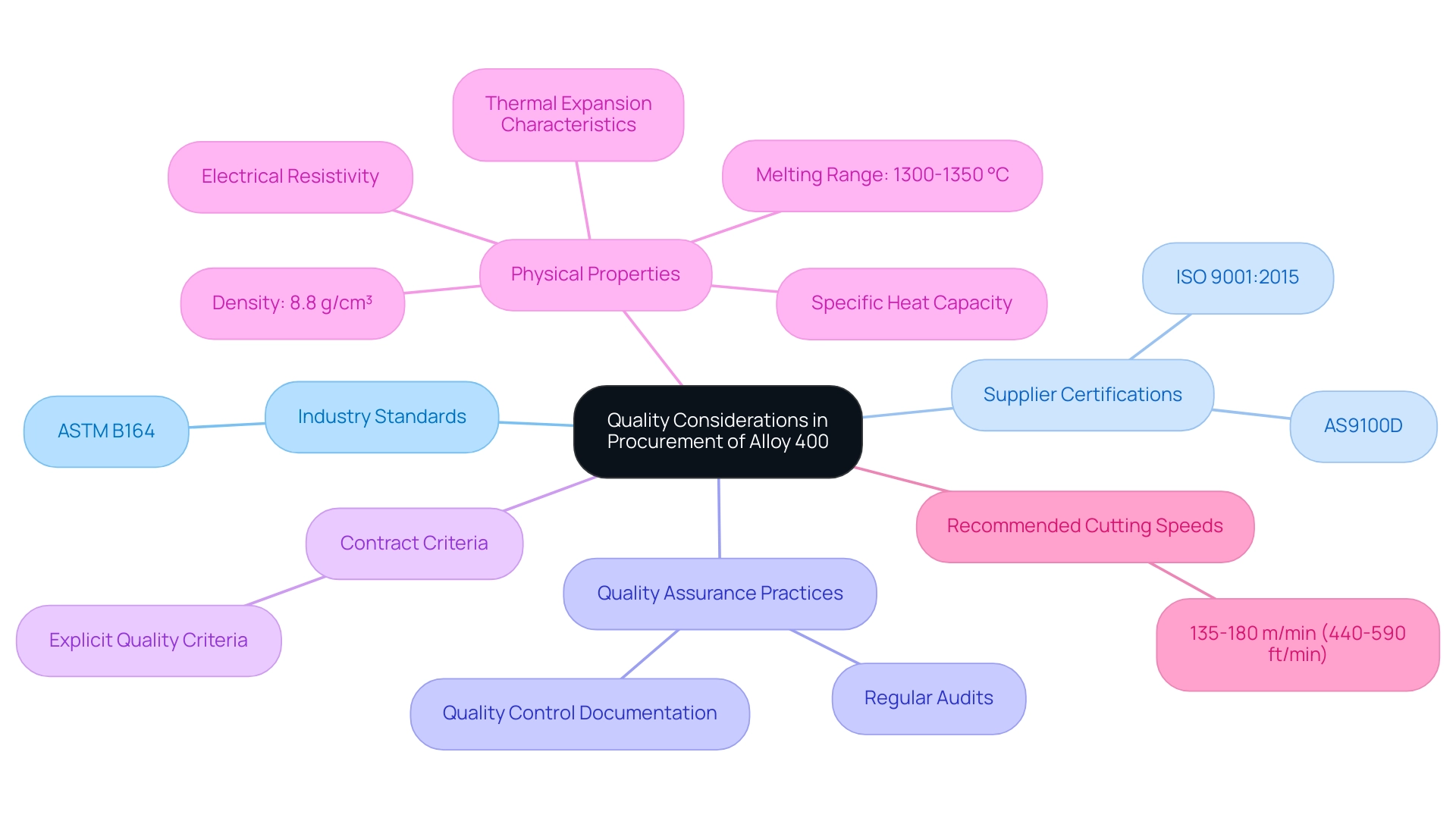

When procuring alloy 400, adherence to industry standards and specifications, particularly ASTM B164, is paramount. Engaging with suppliers who can provide verified certifications, such as the AS9100D and ISO 9001:2015 certifications held by Alloys International, Inc., along with robust quality assurance documentation, is crucial to mitigate compliance risks. Regular audits of suppliers’ quality control practices are essential to detect and address potential material defects proactively.

Furthermore, defining explicit quality criteria in purchasing contracts not only protects your interests but also ensures that the materials sourced meet the operational demands of your projects. Notably, the recommended cutting speeds for drilling this alloy are between 135-180 m/min (440-590 ft/min), which is an important consideration for handling and processing the material. As YICHOU aptly states,

With experience across marine engineering, chemical processing, oil and gas, and industrial sectors, we design products that meet specific operational requirements.

This approach emphasizes the necessity of a strategic partnership with certified suppliers to ensure the integrity and reliability of procurement. Additionally, understanding the physical properties of Alloy 400, such as its density of 8.8 g/cm³ and melting range of 1300-1350 °C, further illustrates its suitability for diverse applications.

Future Outlook for Monel Pricing: Predictions and Analysis

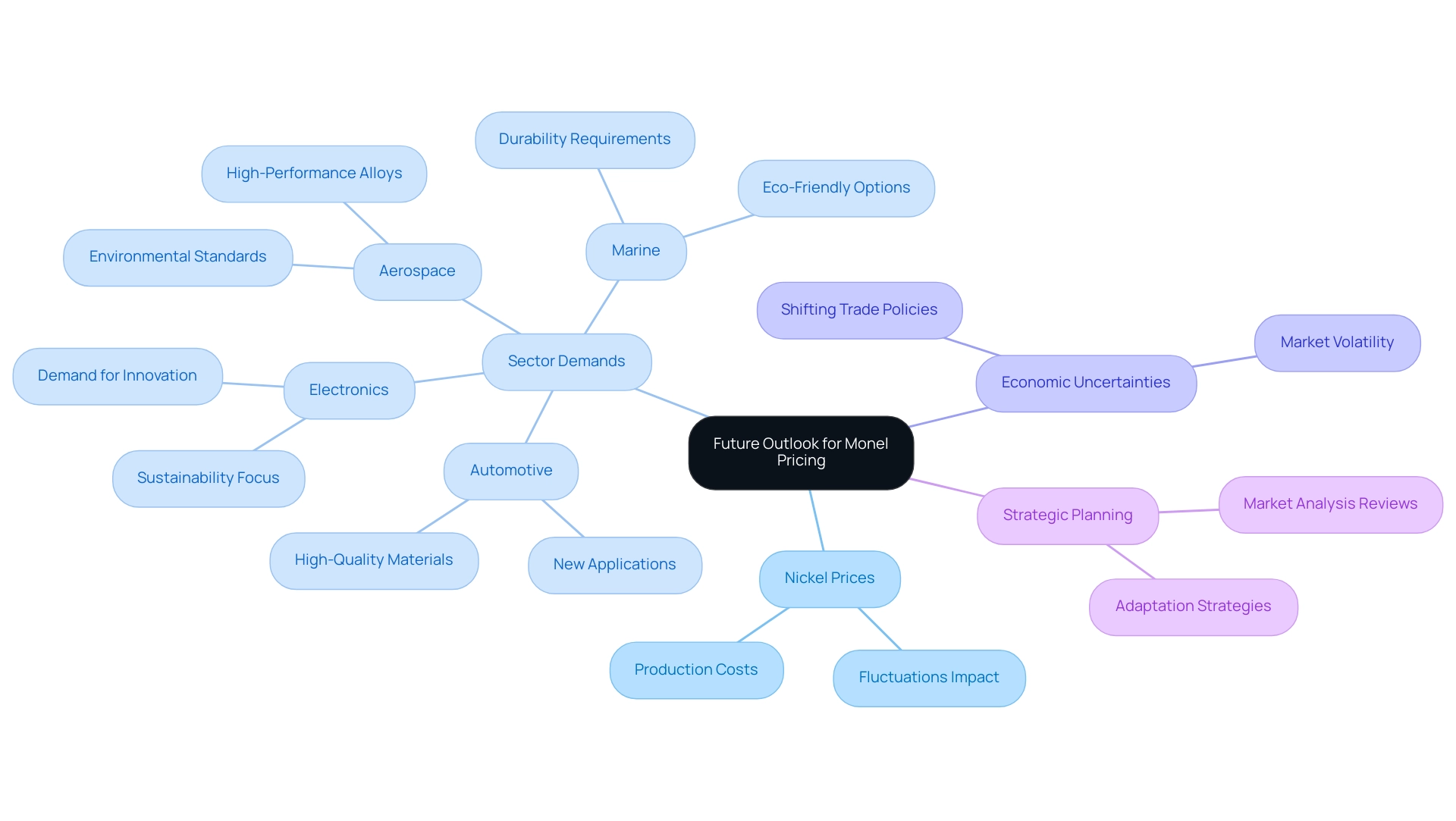

Looking toward the future, analysts anticipate that pricing will be significantly influenced by a variety of factors. Fluctuations in nickel prices are poised to remain a primary influence, as they directly impact the cost of monel production. Furthermore, the evolving demands from key sectors such as automotive and electronics are expected to introduce new applications for this alloy, potentially driving up demand.

Recent reports indicate a marked interest in high-quality and environmentally friendly materials within these industries, particularly in aerospace and marine applications, which further enhances the demand for such alloys. As noted in the segmentation and forecast case study, the Money sector is categorized by type and application, with key players expected to leverage this segmentation for strategic planning and positioning. However, purchasing managers must also be mindful of economic uncertainties and shifting trade policies, which could present challenges to cost stability.

To navigate these complexities, it is imperative for procurement managers to conduct regular reviews of market analyses and adapt their strategies in response to anticipated trends. This proactive approach will ensure they maintain a competitive edge in sourcing Model, particularly in light of the increasing demand from automotive and electronics sectors and the associated pricing predictions for 2024.

Conclusion

Navigating the pricing dynamics of Monel 400 is essential for procurement managers aiming to secure high-performance materials in a competitive market. As outlined, the price range of $20 to $35 per kilogram in 2024 is influenced by several critical factors, including:

- Geopolitical stability

- Supplier strategies

- Market demand

Understanding these variables enables procurement professionals to anticipate price fluctuations and make informed sourcing decisions.

Moreover, establishing strong supplier relationships and implementing effective sourcing strategies, such as:

- Bulk purchasing

- Ethical sourcing

can enhance procurement outcomes. Engaging with reliable suppliers not only stabilizes pricing but also ensures compliance with industry standards, which is crucial for maintaining the integrity of operations across various sectors.

Looking ahead, the future of Monel pricing will be shaped by ongoing fluctuations in nickel prices and the evolving demands from industries such as automotive and electronics. By staying abreast of market trends and adapting strategies accordingly, procurement managers can navigate the complexities of Monel procurement with confidence. This strategic foresight is vital for securing optimal deals and ensuring a reliable supply of this indispensable material.