Blogs

The Global Race for Rare Earths: Who Holds the Key to Clean Energy?

A Spark That Changed Everything

Imagine this: the year is 2032. You step into your garage and plug in your electric vehicle. As the motor hums to life, you’re driving on a technology that depends on a handful of obscure metals buried deep within the Earth. But what if access to those metals is controlled by just a few players? Suddenly, your freedom to drive, to power your home, or to build a sustainable future hinges on geopolitical chess moves. That’s not a sci-fi plot — it’s the reality of the global race for rare earths and how it underpins the clean energy transition.

In today’s blog, we at DOMADIA™ take you behind the scenes of this high-stakes contest: Who holds the cards, how the chemical and technical details matter, and what it means for the future of energy, industry, and sovereignty.

Why Rare Earths Matter — The Backbone of Clean Tech

Rare earth elements (REEs) are a group of 17 metallic elements (the 15 lanthanides plus scandium and yttrium) that have unique magnetic, luminescent, and catalytic properties. While they’re not extremely scarce in the Earth’s crust, they are rarely found in high concentrations, and crucially, their extraction, separation, refinement, and integration into devices is complex, expensive, and environmentally demanding.

In the context of clean energy, rare earths are essential because:

- Permanent magnets made of neodymium-iron-boron (NdFeB) or samarium-cobalt (SmCo) powers high-efficiency electric motors, wind turbines, and generators.

- Phosphors and luminescent materials for LED lighting and displays often use europium, terbium, and dysprosium.

- Catalysts and battery components may incorporate rare earth oxides or compounds.

- Defense and precision systems (e.g. aerospace, radar, satellite systems) also depend on rare earth-based alloys and magnets.

As the clean energy transition accelerates, Deloitte estimates demand for rare earth minerals in clean-energy technologies could grow by 300-700 % by 2040. Deloitte

But the bottleneck is not just demand — it’s supply chain control.

Chemical & Technical Foundations

Chemical Composition & Classification

- The lanthanides (La → Lu) differ primarily by atomic radius and electrochemical behavior.

- They are often categorized as Light Rare Earth Elements (LREEs) — e.g. La, Ce, Pr, Nd — and Heavy Rare Earth Elements (HREEs) — e.g. Tb, Dy, Ho, Er, Y. HREEs tend to be rarer and harder to separate.

- In nature, they often occur in complex mixed mineral matrices (e.g. bastnäsite, monazite, xenotime).

- Extraction involves acid leaching, ion exchange, solvent extraction, precipitation, and several purification stages to produce high-purity oxides, metals, or alloys.

Technical Specifications & Properties

| Parameter | Typical Value / Range | Significance |

| Purity (as oxide) | 99.9 %+ for many purposes | Impurities degrade magnetic or catalytic performance |

| Grain size / microstructure | Nanocrystalline to micron scale | Affects magnetic coercivity and strength |

| Magnetic properties | Energy product (BH_max) for NdFeB magnets: ~ 35–55 MGOe | Higher BH_max => stronger magnet in smaller volume |

| Temperature stability | Some rare earth alloys maintain magnetic performance up to 200-300 °C | Crucial for motors and turbines in high-heat environments |

| Corrosion resistance | Requires coatings or protective treatments | For longevity in harsh environments |

Each step — from mining through magnet fabrication — demands precision engineering and control. The mastery of midstream (separation, refining, alloying) and downstream (magnet manufacture, assembly) is where real strategic power lies.

Who Holds the Keys — Mapping Control in the Global Race

China: The Colossus of Rare Earths

China dominates nearly all segments of the rare earth value chain: mining, refining, separation, magnet manufacture. It produces ~70 % of rare earth ores, and refines over 90 % of world capacity.

China also controls key companies like Shenghe Resources, which invests globally in rare-earth projects.

By restricting exports (e.g. on several medium/heavy rare earths) and controlling technology transfers, China wields leverage over countries increasingly dependent on REEs.

Rising Challengers & Diversifiers

- MP Materials (U.S.) runs the Mountain Pass mine — the only operating rare earth mine/refinery in the U.S.

- Lynas Corporation (Australia/Malaysia) is a major non-Chinese producer of rare earths.

- Energy Transition Minerals (Australia) explores future supplies, including in Greenland.

- Emerging players in Brazil, Kazakhstan, Pakistan, and Africa are attempting to break through. For example, Brazil’s Serra Verde mine just began commercial production to loosen China’s grip.

- Many multinational and startup firms are investing in novel separation technologies (like ligand-assisted chromatography) and magnet manufacturing in the U.S., Europe, and elsewhere.

The global race is not just about geology, but about industrial competence, investment, policy alignment, and resilience.

Applications & Use Cases of Rare Earths in Clean Energy

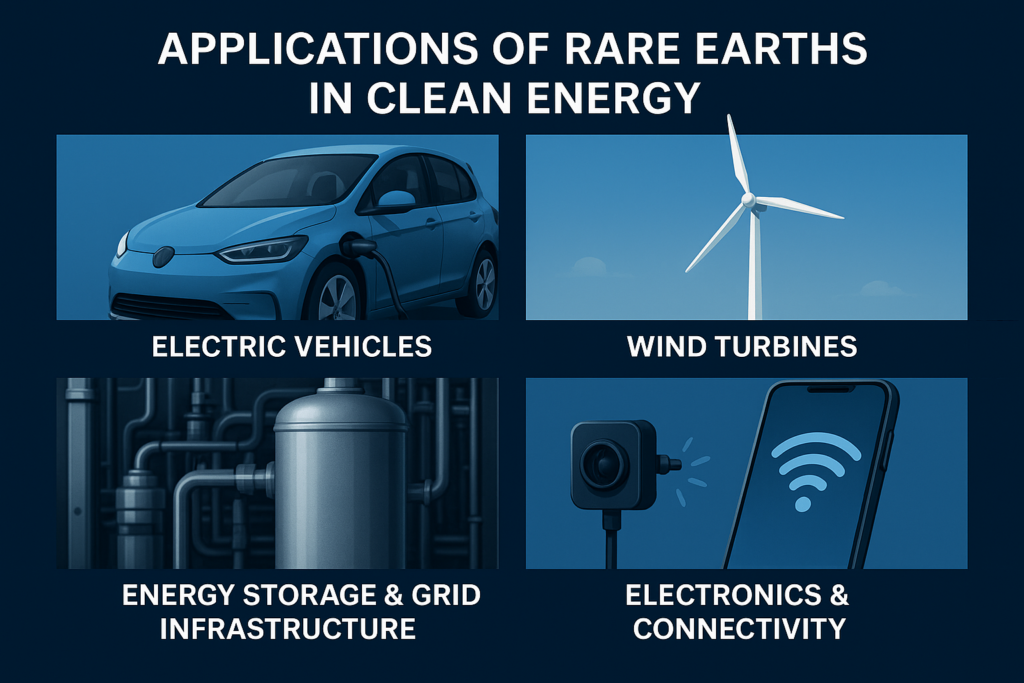

- Electric Vehicles (EVs): Rare-earth magnets (Nd, Pr, Dy) power compact, high-efficiency traction motors.

- Wind Turbines: Gearless (direct-drive) turbines incorporate NdFeB magnets to reduce mechanical complexity.

- Energy Storage & Grid Infrastructure: Rare earth compounds support battery and capacitor technologies, as well as power electronics.

- Electronics & Connectivity: Smartphones, sensors, and optical systems all use rare-earth-based phosphors, alloys, and components.

- Defense & Aerospace: Precision guidance systems, stealth coatings, and advanced materials often require rare-earth elements.

Because so many of these clean technologies are deeply rare-earth–dependent, whoever dominates rare earths effectively shapes the next century’s energy landscape.

Standards, Sustainability & Environmental Challenges

Standards & Governance

- There is increasing interest in international standards for traceability, responsible sourcing, and recycling protocols.

- The WTO, OECD, and other bodies are being pressure points for preventing export restrictions being used as trade weapons.

- National policies (e.g. U.S. Defense Production Act backing for MP Materials) are trying to shore up domestic supply chains.

Environmental & Ethical Impacts

- Rare earth extraction generates toxic waste, acid drainage, and radioactive by-products if poorly managed.

- Water consumption and land degradation are serious concerns in many mining regions.

- Recycling of rare earths is extremely hard: global recycling rates remain below ~5 %.

- Countries depending heavily on scrapping or replacing rare-earth-based equipment impose long-term environmental burdens.

In short: the race for rare earths is not just a resource competition, but a test of sustainability, regulation, and responsibility.

The Stakes & Strategic Takeaways for DOMADIA™

The global race for rare earths is not a distant geopolitical drama — it’s central to the clean energy, industrial, and defense transitions underway worldwide. For companies like DOMADIA™ operating in advanced materials or clean technologies, this race offers both risks and opportunities:

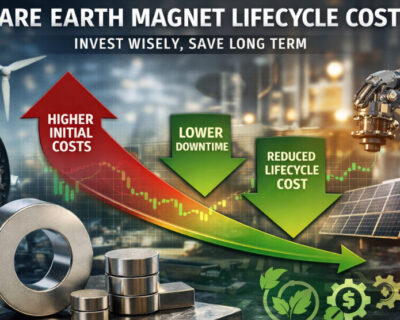

- Supply resilience matters more than cost alone. Even if you find cheaper sources, lack of downstream processing or unexpected trade restrictions can cripple your operations.

- Vertical integration is powerful. Control over separation, alloys, magnet fabrication, and recycling is as critical as owning a mine.

- Sustainability is a differentiator. Markets and governments will increasingly demand traceability, low-impact mining, and closed-loop recycling.

- Alliances shape the playing field. Collaborate across geographies, with governments, research institutions, and cross-border supply chains.

Call to Action & Takeaway

If you are in the energy, electronics, or materials sector, now is the moment to audit your supply chain, invest in alternatives, and seek partnerships in emerging rare-earth ecosystems. DOMADIA™ stands ready to support clients with insights on strategic sourcing, material substitution, and sustainable practices.

This race will not be decided by raw resource alone — it will be governed by who masters the complexity, controls mid-to-downstream technology, and aligns with environmental and geopolitical constraints.

Rare earths define the next century of energy.

Make sure your business isn’t left behind.

⚙️ Partner with DOMADIA™ — Innovate. Source. Sustain.

Talk to us: Kairav Domadia | Aadil Domadia | Er.Pankaj Domadia | Pragati Sanap | Pooja N N

#RareEarths #CleanEnergy #Sustainability #GlobalSupplyChain #RenewableEnergy #DOMADIA #Innovation #EnergyTransition #Technology #Mining #StrategicMaterials